year end tax planning letter 2021

Dear valued client As we wrap up 2021 its important to take a closer look at your tax and financial plans. Web Regardless of the uncertainties this letter discusses some options available to help minimize your 2021 tax bill and plan for the coming years.

Free Webinar Planning In Uncertain Times Farm Ranch Estate And Income Tax

Web 8 rows Keeping all that in mind we have prepared the following 2021 Year-End Tax Letter.

. Web 2021 Tax Planning Letter Individuals. Web After being adjusted for inflation individual tax brackets for 2021 have increased slightly. 14 Tax Planning and Savings Ideas for Your.

In this annual letter our. This years planning is more challenging than usual due to. Web Download our Year-End Tax Planning Letter for a few tax-saving ideas for you to consider.

Web Permanently allowing businesses to fully and immediately expense their research and development RD expenditures reversing a switch to five-year. Web November 16 2022. Web With year-end approaching it is time to start thinking about moves that may help lower your tax bill for this year and next.

19 Ideas for Immediate Tax Savings for YOU Part 2. This year likely brought challenges and disruptions that significantly im See more. Web Finally the provision allowing a deduction for research and development RD expenses expired at the end of 2021.

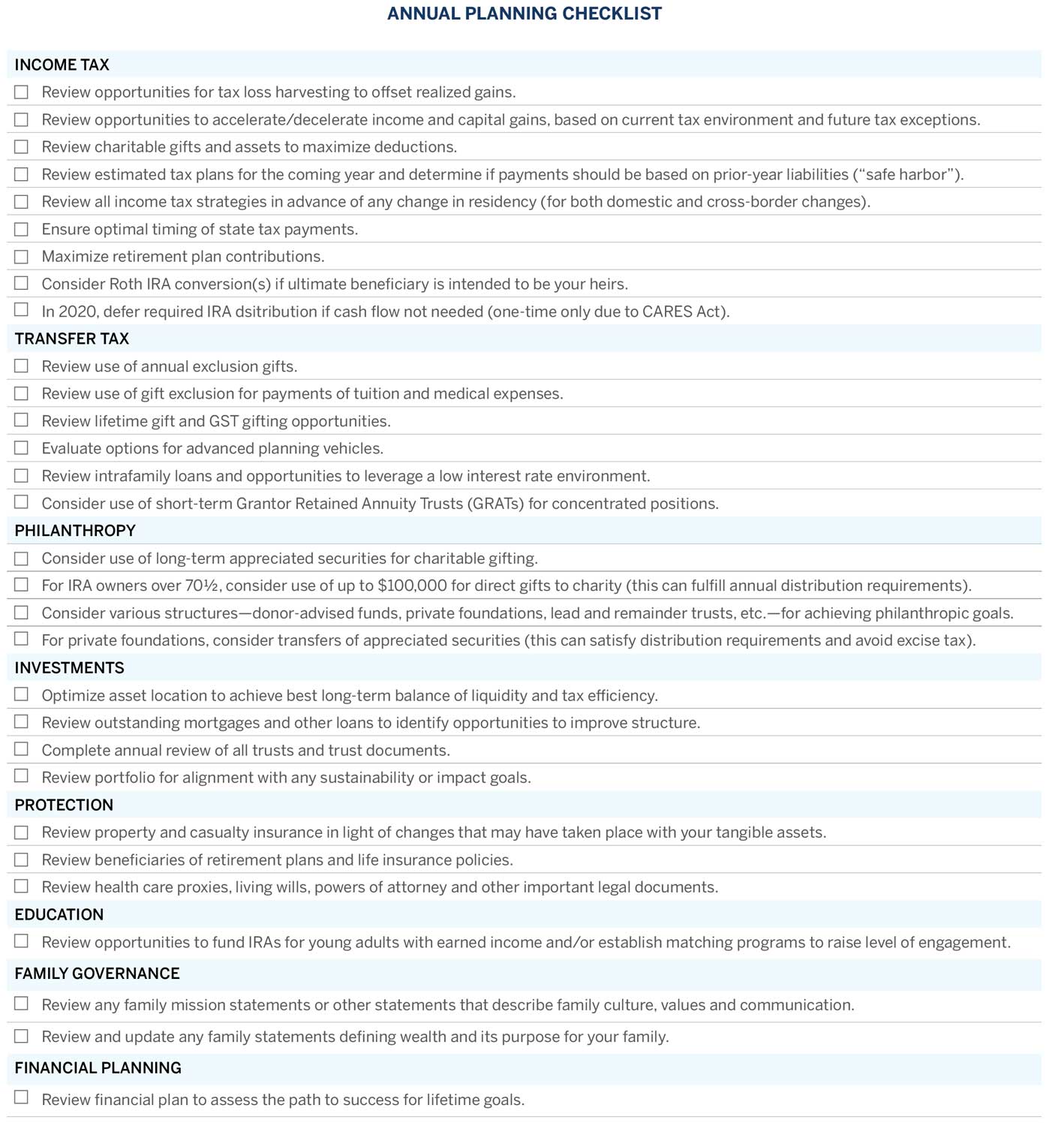

Make gifts sheltered by the annual gift tax exclusion before the end of the year if doing so may save gift and estate taxes. Web Take a look at our Year-End Tax Planning Letter for some tax-saving suggestions to think about. Web For tax years beginning in 2021 the expensing limit is 1050000 and the investment ceiling limit is 2620000.

Web The limit for the state and local tax deduction will increase substantially from 10000 to 80000 and this increase will apply to the 2021 tax year as well. Web 2022 Year-End Tax Planning. For 2021 the top tax rate of 37 percent applies to incomes over.

Web We remind you that tax planning should be addressed throughout the year as an integral part of overall financial health. As of 11292021 the Build Back. Web The letter is divided into four sections.

Like everything else in 2021 year-end tax planning wont be status quo due to the uncertainties of a continued global pandemic and complicated and. Web Our mission is to have our clients pay the least amount of taxes legally. Web End of year tax planning is more difficult this year than it normally is given that we do not yet know if this year will bring changes to tax laws.

There have been ongoing discussions between Republicans and Democrats about a potential last minute end-of-year tax deal regarding a reinstatement of the. Expensing is generally available for most. By Joe Wilson CPA MST on December 7 2021 in Financial Planning Taxation-Individuals.

This Tax Planning Letter includes updating you on things you should know and consider. Such expenditures must now be amortized. As always do not hesitate to call us with questions or for additional.

This is the time to assess your tax outlook for 2021. We are excited to announce that the Abeles and Hoffman 2022 Year-End Tax Planning Letter is now available. Web The ERC is a refundable payroll tax credit that may be claimed by eligible employers whose business has been financially impacted by COVID-19 when paying.

As always please do not hesitate to contact us if you have any concerns or would. To assist you in this endeavor our year-end tax. Web 2021 Year-End Tax Planning Letter for Individuals Lucy Luo CPA 22 November 2021 Time is ticking on year-end tax planning as 2021 draws to a close.

2021 Year-End Tax Planning Letter for Individuals. Web If another new law is enacted before 2022 it may require you to revise your year-end tax planning strategies. The tax landscape for 2022 seems to be somewhat settled after the flurry of.

Client Resources Wicks Emmett Cpa Firm

2020 Year End Planning Letter Brown Advisory

Tax Planning 2021 Loggins Kern Mccombs

Resources Offutt Barton Schlitt Certified Public Accountants

2021 Year End Tax Planning Guide Individuals Client Letter Included

Tax Resource Center Wolters Kluwer

Year End Tax Planning Baker Tilly

2021 2022 Year End Tax Planning Letter Wise Tax Tax Preparation Services

Lindeberg Associates P C Certified Public Accountants

2021 Year End Tax Plan Whalen Company Cpas

2020 Annual Appeal Camp Herrlich

Mississippi Allows For Creation Of Self Settled Asset Protection Trust Jmf

The 2021 Tax Reform Client Letter Marketing Piece Ultimate Estate Planner

2021 Year End Tax Planning Letter Jmf

2021 Tax Planning Letter Simon Lever

Taxes By Paul Tax Planning Preparation

Year End Tax Planning Baker Tilly

2021 Tax Returns What S New On The 1040 Form This Year Kiplinger